Enhancing capital efficiency in DeFi

By Walodja1987 at

TL;DR: DeFi is often criticized by traditional finance folks for being capital inefficient due to the full collateralization requirement. This article explores how traditional finance achieves capital efficiency through the practice of fractional reserve and presents a comparable mechanism to enhance capital efficiency in DeFi. The described mechanism offers improved transparency and enhanced protection for end-users and taxpayers compared to traditional setups. While this article uses insurance built on top of DIVA Protocol as an example use case, the model can be extended to prediction markets and any other DeFi application requiring full collateralization.

✨ Introduction

Traditional insurance companies operate on a fractional reserve basis, maintaining only a portion of the maximum potential liabilities in reserve. This practice capitalizes on the uncorrelated nature of risks, making it highly unlikely that an excessive number of insurance claims will be triggered simultaneously, leading to a default.

In contrast, Decentralized Finance (DeFi) protocols, such as DIVA Protocol, require users to fully collateralize their future obligations upfront. While this ensures that all potential claims are covered, thus reinforcing the trustless nature of DeFi, it also greatly limits capital efficiency, reducing the number of policies that can be underwritten relative to traditional settings. This fundamental difference poses a significant challenge for traditional financial institutions considering DeFi integration.

In this article, we will examine the concept of fractional reserve and then derive a comparable mechanism to achieve capital efficiency in DeFi, using insurance as an example use case. Additionally, we will provide a high-level technical implementation guide.

🎬 Setting the stage

Vlad plans to build an agricultural insurance business using DIVA Protocol, an open decentralized finance infrastructure to create and manage conditional payment agreements without using banking rails. He issues two harvest loss insurance policies, each fully collateralized with $1,000, and sells them to Bob, a farmer in India, and Alice, a farmer living in Kenya, for $150 each. Vlad collects a total of $300 in premiums and locks up $2,000 in collateral.

In comparison, a traditional insurance company that operates on a 50% fractional reserve basis, would only keep $1,000 in reserve, allowing it to underwrite twice as many policies as Vlad, earning $600 using the same amount of collateral. This highlights the perceived capital inefficiency of DeFi.

🧪 Understanding fractional reserve

By running a fractional reserve, traditional insurance companies effectively bet that the total claims submitted will not exceed a certain threshold. For instance, if they sell coverage totaling $2,000 but maintain only $1,000 in reserve, they essentially bet that claims will not surpass $1,000. If an excessive number of claims is filed at once though, the insurance company would not be able to cover its liabilities, resulting in a default.

Who absorbs the insurer’s shortfall risk? Who will step in to cover the deficit if a shortfall occurs?

In an ideal scenario, the insurance company buys insurance against such an event from a reinsurance company specialized in assessing and consciously accepting those types of risks. However, often it is either the policyholders themselves who will not receive their promised payout or the government, and by extension the taxpayers, who will step in to compensate the policyholders.

One of the most significant examples is the bailout of American International Group (AIG), a global insurance corporation, during the 2008 financial crisis. AIG faced severe liquidity issues due to its exposure to credit default swaps and other risky financial products. The U.S. government intervened to prevent a collapse affecting the global financial system. This intervention included an initial bailout of $85 billion from the Federal Reserve, with the total support eventually amounting to approximately $182 billion.

The key takeaway from this section is that in a fractional reserve system, the burden of covering a shortfall from excess claims is shifted to another party, knowingly or unknowingly.

In the next section, we will explore how we can enable a similar risk transfer mechanism in DeFi while maintaining full collateralization.

🎨 Applying fractional reserve principles to enhance capital efficiency in DeFi

Vlad‘s goal is to unlock a portion of the $2,000 collateral tied up in the two policies in order to be able to underwrite additional policies. By releasing $1,000, he would still have $1,000 in reserve, sufficient to cover obligations in three out of the four possible scenarios.

However, Vlad is programmatically prohibited from withdrawing any funds from DIVA Protocol prior to the policies‘ expiration. This prevents him from silently transferring shortfall risk to policyholders or taxpayers, a common practice in traditional settings. Consequently, his only option is to transfer the risk to a party that is willing to cover the shortfall.

Setting up a reinsurance policy using DIVA Protocol, similar to the original insurance policies, which would cover the shortfall by paying out $1,000 if both policies trigger is not an option as the funds would be locked inside DIVA Protocol until the policy‘s expiry, leaving Vlad without the immediate liquidity he needs to underwrite additional policies.

To address both needs, transferring shortfall risk and receiving immediate capital, Vlad can bundle and securitize the collateral recoverable from the policies into a synthetic asset and use it as collateral to secure a loan.

Illustrating the payout structure of the synthetic asset

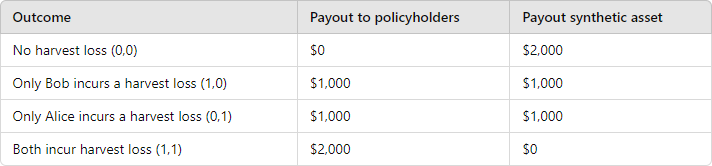

The payout of the synthetic asset mirrors the amount of collateral recovered from the two policies combined. Below table illustrates the payouts under the four possible scenarios:

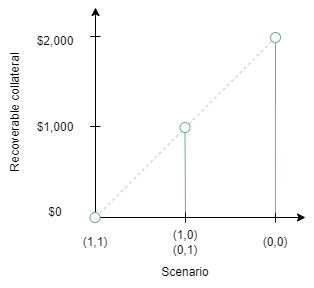

The synthetic asset returns $2,000 if no claims are triggered, $1,000 if one policy triggers, and $0 if both trigger. This is depicted in the following chart.

This intrinsic value of the synthetic asset enables it to be used as collateral to secure a loan from a lender willing to accept the risk of a total loss arising from the synthetic asset becoming worthless when both policies trigger.

In three of the four scenarios - (0,0), (1,0), and (0,1) - the synthetic asset would generate enough payout to repay the lender. However, in the (1,1) scenario, the asset becomes worthless, resulting in a total loss for the lender.

To compensate for the risk of loss, the lender could offer Vlad $950 and expect a repayment of $1,000 when the policies expire, earning a yield of 5.26%. This could be an attractive arrangement if the probability of both policies triggering simultaneously is estimated to be low (e.g., 1%). The pricing of these risks is a complex topic and beyond the scope of this article.

This strategy could be scaled to any number of policies that Vlad has underwritten. For example, with 1000 policies, each pre-funded with $1,000, Vlad could opt to transfer the risk of claims exceeding $600,000, effectively freeing up nearly $400,000 in capital (a bit less due to the risk premium demanded by the lender).

In this section we have seen how securitizing the recoverable collateral from a portfolio of fully collateralized positions and then borrowing against the resulting synthetic asset provides an effective way to recover a portion of the pre-funded amount, while preserving the assurance that all future policyholder claims will be honored. This concept extends beyond insurance and can be applied in prediction markets or other DeFi applications that demand full collateralization.

This concludes the theoretical discussion. Next, we will examine the practical implementation of this mechanism by combining various DeFi building blocks.

🧰 Technical implementation

In this section, we will walk through the technical steps required to implement the presented mechanism using DIVA Protocol in conjunction with a lending protocol like Myso v2, Morpho or Euler v2.

The implementation involves the following key steps:

2. Bundle and securitize the positions representing the recoverable collateral into a single synthetic asset.

3. Borrow funds using the synthetic asset as collateral.

4. Recover any remaining collateral from the policies.

5. Repay the lender.

6. Transfer any excess funds to the borrower.

Create

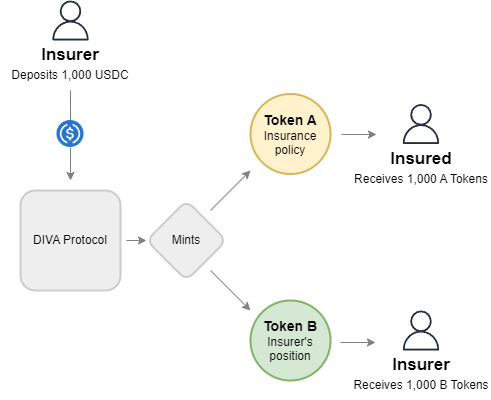

Using DIVA Protocol, an insurance policy can be created by specifying the policy parameters including the trigger conditions (e.g. harvest loss) and expiration, and then pre-funding it with the insurance cover amount, denominated in a USD-pegged stablecoin such as USDT or USDC.

This process results in the issuance of two conditional claims on the funds, both represented as ERC20 tokens:

2. Token B, representing the insurer's position, which is inversely related to Token A and redeemable if no harvest loss occurs. This token effectively grants the right to recover any remaining collateral.

By repeating this step for every new policy, a diverse portfolio of B tokens is built up, with each token distinctly connected to an individual policy.

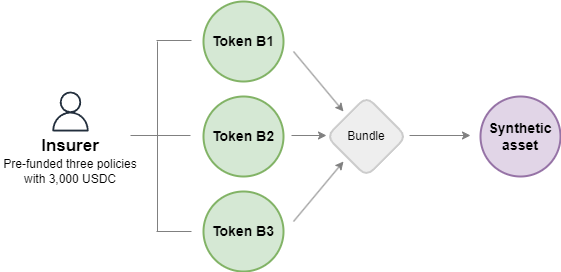

Bundle and securitize

The second step involves bundling the B tokens in a vault and securitizing its payout into a single synthetic asset, represented as an ERC20 token. One approach is to transfer each B token after policy creation individually to a vault, such as thirdweb‘s multiwrap contract. Once consolidated, a synthetic asset can be issued against that vault, representing a claim on the collateral amount recoverable from the bundled positions.

A more cost-effective approach is to designate the vault directly as the recipient of the B tokens at the moment of policy creation. This method eliminates the need for separate transfer transactions, thereby reducing transaction costs.

For optimal efficiency, it is recommended that all policies are pre-funded with the same stablecoin, streamlining the financial operations associated with borrowing and repayment.

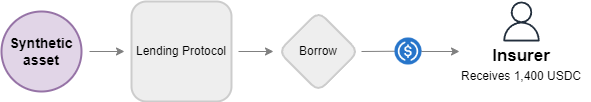

Borrow

The next step is to find a lender willing to issue a loan against the synthetic asset. Existing lending protocols like Myso v2, Morpho or Euler v2 can facilitate this process.

Two essential features are required for the chosen lending protocol:

- The ability to accept any ERC20 token as collateral, allowing the synthetic asset to be used for this purpose.

- The absence of a liquidation mechanism, allowing the lender to incur a loss if the collateral value falls below the loan amount.

The specifics of the borrowing process will vary depending on the chosen protocol. Typically, it involves either receiving a signed loan offer from potential lenders or placing a borrow offer at desired terms. Once an offer is accepted, the synthetic asset is deposited and locked in an on-chain escrow, where it remains until the loan reaches maturity, and the loan funds are transferred to the borrower.

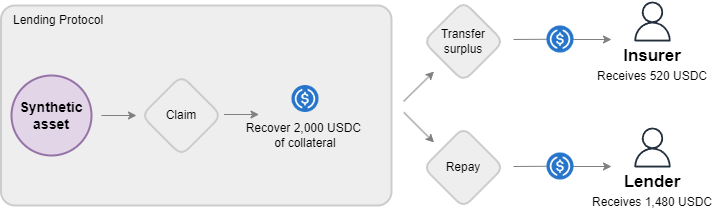

Claim, repay and transfer

Upon the expiration of the policies, the B tokens must first be redeemed/liquidated for the underlying stablecoin from DIVA Protocol. These funds are then used to repay the loan, with any surplus returned to the borrower (the insurer).

The implementation of the repayment mechanism necessitates the development of an adapter contract that interacts with both DIVA Protocol and the lending protocol. If you are interested in contributing to its creation, please reach out on our Discord.

🌔 Conclusion

This article has presented a framework for enhancing capital efficiency in a fully collateralized DeFi system by applying the principles of fractional reserve systems in a decentralized context. By pre-funding insurance policies and refinancing them through lenders, an insurer can return a portion of the collateral initially locked to back the policies, thus enabling the underwriting of additional policies. Crucially, this approach maintains the trustless nature of the system, ensuring that all positions remain fully collateralized.

This framework has broader applications beyond the insurance sector. It can be adapted to prediction markets, which can also be facilitated by DIVA Protocol, and other DeFi applications that require full collateralization.

Adopting such models could significantly enhance transparency, improve protection for end-users, and potentially ease the regulatory burden for insurers. However, the success of this mechanism largely depends on the presence of sophisticated lenders who can effectively assess and manage the associated risks. As this sector continues to evolve, there is a significant opportunity for community involvement and development, especially in refining and scaling these solutions. For those interested in discussing, contributing to, or implementing this model, please reach out on our Discord.

📈 About DIVA Protocol

DIVA Protocol is a universal smart contract-based system for creating and managing derivative financial contracts peer-to-peer. It provides the foundation for enabling a wide range of financial applications including insurance, prediction markets, conditional donations, structured products, swaps, bets, and more, all operated fully automatically and without central intermediaries. As an open-source protocol, DIVA is freely accessible, empowering everyone to innovate and build applications that contribute to a more robust financial ecosystem.

🔗 Links

- 🌐 Website: divaprotocol.io/

- 🍏 Github: github.com/divaprotocol/diva-protocol-v1

- 📚 Docs: docs.divaprotocol.io/

- 🦜 Twitter: twitter.com/divaprotocol_io

- 🤖 Discord: discord.gg/8fAvUspmv3