Flash loans in DIVA Protocol

By Walodja1987 at

TL;DR: This article explores the use of flash loans in prediction markets built on top of DIVA Protocol, aiming to enhance user experience and optimize market making activities. This idea is inspired by a prediction market app currently under development.

In prediction market applications, ease of use for participants is key. Users should be able to easily place bets on outcomes and close their positions with a simple click.

This simplicity is achieved by limiting users to market buys and sells of the corresponding outcome shares, reserving the complexity of limit orders for advanced market participants like market makers.

In DIVA Protocol, market makers are essential for liquidity, as they mint position tokens to sell them on the market for a profit. This process involves (i) depositing funds into DIVA Protocol to mint equal quantities of LONG and SHORT position tokens (which combined represent a claim on the deposited funds) and (ii) placing sell limit orders via decentralized protocols such as 0x Protocol, facilitating market buys for users. The goal is to sell these tokens to two independent users for an amount exceeding the initial deposit.

Example: Bob deposits $100 into DIVA Protocol to mint 100 LONG and 100 SHORT Tokens. He then lists the 100 LONG tokens for sale at a total price of $60 and the 100 SHORT tokens at $45. With Charlie buying the LONG tokens and Emily the SHORT tokens, Bob earns a profit of $5.

Furthermore, in order to enable users to close their positions via market sell, market makers must provide buy limit orders for both tokens. Consequently, a market maker would have to maintain a four-sided market to achieve the desired simplicity for users. This is adding complexity and operational burden.

The following sections will detail how integrating flash loans can significantly reduce this complexity, offering a more streamlined approach for market makers.

💎 Closing positions with opposite outcome token

The first step towards reducing the complexity for market makers is to realize that instead of selling their position, users can buy an equivalent amount of the opposite outcome token and redeem them for collateral via DIVA Protocol.

Example: Let's say Alice has 100 LONG tokens, each priced at 20c. Directly selling these tokens would yield her $20. Alternatively, Alice could achieve the same outcome by buying 100 SHORT tokens, trading at an implied price of 80c each, for a total of $80, and redeeming both for $100 from DIVA Protocol, netting her $20.

Yet, an issue arises since Alice needs funds ($80 in our example) to purchase the opposite token, which may not be always available.

What if Alice could briefly borrow the necessary funds to buy the opposite token and immediately repay the loan upon redeeming the collateral from DIVA Protocol? That’s where flash loans come in.

⚡ Flash loans

Flash loans introduce an innovative form of lending unique to the blockchain world. These loans do not require collateral but must be repaid within the span of a single smart contract transaction. Failure to do so results in the reversal of the entire transaction, thus eliminating any repayment risk.

To grasp the concept of flash loans, particularly for individuals that come from traditional finance, it's essential to understand the atomic nature of smart contract transactions. Essentially, a smart contract transaction comprises a sequence of instructions executed as one unit. Should any part of this sequence fail, the entire transaction is undone, leaving the blockchain unchanged.

A flash loan is integrated as a specific instruction within a smart contract transaction. It involves borrowing funds at the transaction's start and repaying them by its conclusion. Overcollateralized lending protocols like Aave, Compound or MakerDAO have flash lending capabilities integrated into their protocols for public use.

To illustrate, consider Alice’s situation again: She owns 100 LONG tokens valued at 20c each and aims to liquidate her position. With an implied SHORT token price of 80c, the following steps are executed as part of a single smart contract transaction:

- Borrow $80 from Aave

- Purchase 100 SHORT tokens with the $80

- Redeem 100 LONG and 100 SHORT tokens from DIVA Protocol for $100

- Repay the $80 loan, retaining $20 as the net proceeds, mirroring the direct sale of LONG tokens

The example shows how the flash loan instructions (steps 1 & 4) encapsulate the transaction's other operations (steps 2 & 3), allowing for their replacement with any other operations, such as exploiting arbitrage opportunities or refinancing outstanding loans.

🫰 Presence of fees

In our previous example, we omitted flash loan fees, trading fees and redemption fees for the sake of simplicity. However, in reality, those fees are not zero. Aave charges a 0.09% interest on the flash loan, DIVA Protocol applies a 0.25% upon redemption, the trading fee is also typically non-zero.

Intuitively, in the presence of fees the net dollar amount received at the end of a transaction will be lower, introducing the possibility that the flash loan cannot be repaid.

To illustrate the impact of fees, let’s revisit our previous example, assuming the standard Aave and DIVA fees and a 1% trading fee:

Scenario 1: Alice intends to liquidate her LONG tokens, which are traded at 20c and the implied SHORT token price being 80c.

- Borrow $80.80 from Aave to cover the $80 purchase price for 100 SHORT tokens and the trading fee of $0.80, leading to a repayment amount of $80.80*1.0009 = $80.8727

- Purchase 100 SHORT tokens for $80.80 including trading fee

- Redeem 100 LONG and 100 SHORT tokens from DIVA Protocol for $100*(1-0.0025) = $99.75 after the redemption fee

- Repay the $80.8727 loan, yielding $18.8773 net proceeds after all fees (vs. $20 in the absence of fees)

Here, the funds available after fees ($99.75) suffice for loan repayment ($80.8727), ensuring the transaction concludes successfully. In mathematical terms we have: $99.75 - $80.8727 >= 0.

Scenario 2: Now let’s consider a scenario where Alice’s LONG token is valued at 1c, with the SHORT token priced at 99c.

- Borrow $99.99 from Aave to cover the $99 purchase price for 100 SHORT tokens and the trading fee of $0.99, leading to a repayment amount of $99.99*1.0009 = $100.08

- Purchase 100 SHORT tokens for $99.99 including trading fee

- Redeem 100 LONG and 100 SHORT tokens from DIVA Protocol for $100*(1-0.0025) = $99.75 after the redemption fee

In this case, loan repayment is not possible since the available funds after step 3 ($99.75) are less than the required repayment amount ($100.08), leading to a transaction failure. In mathematical terms we have: $99.75 - $100.08 < 0.

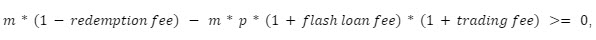

From these reflections, we can derive a general formula to calculate the threshold price of the opposite token that ensures loan repayment:

where p represents the price of the opposite token, and m the quantity of the owned token being liquidated (100 in our previous example).

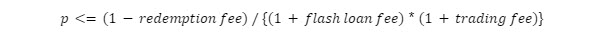

Simplifying this formula yields:

Under the assumed fee structure, the threshold price p would be $0.986736, meaning that the flash loan will succeed if the price of the SHORT token is less than or equal to $0.986736.

💡 Additional considerations

In a scenario where a user has sufficient funds to buy the opposite side, no flash loan is needed. To address instances where a user has partial funds, the smart contract function that triggers the flash loan based liquidation operations could be designed to accept the loan amount as an input parameter.

🌔 Conclusion

This article explored a flash loan-based approach for liquidating derivative positions created on DIVA Protocol, aimed at enhancing the user experience and streamlining market-making processes.

If this concept piques your interest, we invite you to join us in the development of this (small) smart contract adapter to expand the DIVA infrastructure ecosystem.